It's hard to say without looking online when the digital world began and filled every part of our lives. Now you can work online, shop online, study online, get medical help online - it's easily accessible. You can pay for almost anything online and with your smartphone, and it's no surprise that digital banking has become an integral part of our daily lives.

In this article, you will find all the information you need on how to start an online bank, the digital segment of the industry, key points to consider, and the software production process. So, let's learn how to build a digital bank from scratch, step by step.

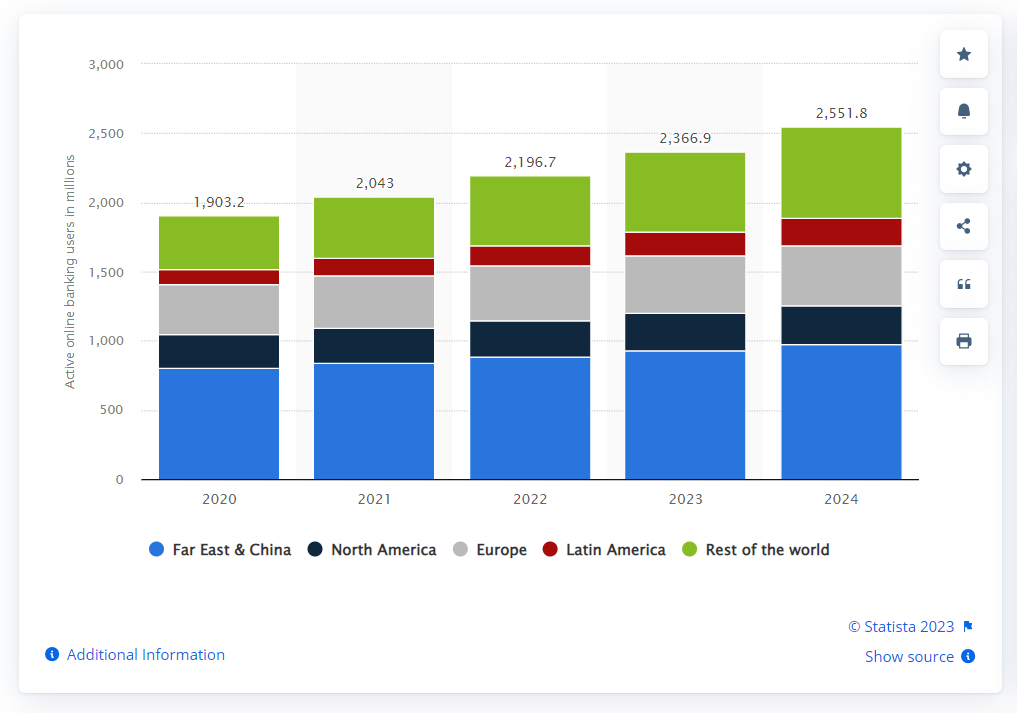

Number of active online banking users worldwide in 2020 with forecasts from 2021 to 2024, by region (in millions)

6 TRENDS IN ONLINE BANKING TECHNOLOGY

The main trend in today's technology and lifestyle is simplicity and convenience. This is what digital banks are all about - making banking quick and easy.

What is needed to create a virtual bank? Later we will discuss what to consider when starting an online bank. But first, let's learn about the trends and technologies used in digital banking.

Artificial Intelligence (AI) and Chatbots

AI is used to personalize the customer experience, provide financial insights, and offer automated customer support through chatbots. Chatbots can answer common queries, assist with account management, and even provide investment advice. For example, the Bank of America Erica chatbot, powered by artificial intelligence, has recently crossed the 1 billion customer interaction mark, according to recent data. Nearly 32 million Bank of America customers manage their financial lives with Erica's help.

Open Banking and APIs

Open Banking initiatives allow customers to share their financial data with third-party applications and services securely. This in turn makes possible the cooperation of banks and fintech firms, in the form of providing clients with access to financial services through a single platform. For example, one of the most obvious conveniences for clients is account aggregation. This means that customers can see multiple of their accounts from different providers in one interface. And this is not limited to just a few different payment accounts. Today, it is becoming possible for consumers to view credit cards, loan accounts, and investment accounts in one place, and even combine consumer and business banking processes in one interface. Platform examples: Plaid, Tink, Nordic API Gateway.

Blockchain and Cryptocurrency Integration

The integration of blockchain and cryptocurrency in online banking has the potential to transform the financial industry, offering increased security, efficiency, and accessibility. Thanks to these technologies, banks today can offer their clients cryptocurrency accounts, crypto wallet services, cross-border payments, smart contracts, asset tokenization, etc.

Neobanks

This is a relatively new type of bank that provides banking services only through digital channels. Since these banks do not have physical locations, they can provide banking services at lower prices than traditional banks and their services become more accessible. Among the most popular neobanks in the US by the number of open accounts are Chime (14.4 million), Varo (3.8 million), and Aspiration (3.6 million).

Cybersecurity

To protect customer data and prevent cyberattacks, banks need to invest in advanced cybersecurity measures today. Biometric authentication, artificial intelligence, and machine learning are increasingly gaining momentum to detect and prevent fraud.

Voice Banking

Voice-activated virtual assistants like Amazon's Alexa and Google Assistant are being used for voice banking, allowing customers to check balances, make payments, and perform other banking tasks using voice commands.

WHAT DOES IT TAKE TO BUILD A VIRTUAL BANK? 9 KEY POINTS TO CONSIDER

1.Your Target Audience

It's nothing new that you should do a target audience analysis.

- What services do your potential clients usually use?

- What do they like or dislike about the services they have previously received?

- What do they worry about when using the Internet or making online payments?

Asking questions like these is the first thing any digital banking entrepreneur will do.

But, what’s more important, about this stage is to get factual data and conduct statistical analysis. Only this can help you launch a successful product.

Steps To Take

- Form a focus group and a list of questions that you need to be answered, before you start your own bank online, in order to get it right.

- If you are not confident to do it on your own, find an agency that does research and statistical analysis.

- Build predictive models for possible consumer behavior.

- Use social media networks and forums. For example, on Reddit, you can post questions, chat with potential customers, and learn what their struggles are concerning digital banking services.

Target audience analysis helps you figure out important details about their desires and needs which are necessary to know before developing a bank.

2. Competitors Analysis

Target audience analysis also answers the question “who your competitors are”. It’s an important detail you absolutely need to know before you start a mobile bank development.

Steps To Take

- Create a list of criteria and a scoring system to evaluate your competitors.

- Study their strength and weaknesses.

- Find out what technology they use and how they market their products.

- Analyze what their customers think about their services, good or bad.

- Compare your digital banking ideas to competitor products.

Analysis of your competitors can help you successfully create a digital bank value proposition — a statement of your benefits, why customers should use your services, and how you are going to solve their problems and improve their lives.

3. Bank MVP Сreating

An MVP is a version of a product that allows you to collect sufficient data in order to learn how potential customers interact with your product.

Steps to Take

- Create a prototype of your user interface.

- Decide on core features.

- Сollect feedback from the audience who were shown the first version of the product.

- Plan iterations to improve the product and add all the necessary features, such as balance and transaction analysis, notification system, secure authorization, activity analysis, managing multiple cards, and effective support.

4. Types Of Business Models

Another thing you need to figure out before you start a virtual bank is how your product is going to be structured. Here are the four most prominent types of digital banking business models.

Aggregators — distributing financial services from an ecosystem of partners. If you decide to build a virtual bank on this model, you will:

- Reduce the costs of manufacturing the services.

- Offer more kinds of services that a bank alone can’t, including non-financial service.

- Provide your partner banks with advice on better financial decisions based on the data aggregated from your clients.

Open platforms — open banking APIs; a strategy that facilitates value exchange, expands the customer and partner bases, and gives more opportunities for acquiring capital. If you want to build a bank on this model, keep in mind that there are four main platform banking models:

- Proprietary: single sponsor and single provider; APIs are used as a mediator between developers (give access to data) and customers (give access to the final product).

- Licensing: single sponsor and many providers; provides a visible interface for consumers and developers.

- Shared: many sponsors and many providers; multiple partners control the development process.

- Joint venture: many sponsors and a single provider; a shared interface that encourages collaboration among sponsors (e.g., fintech companies).

Banking as a Service (BaaS) — a cloud-based model where tech companies can operate as banks after acquiring appropriate licenses. If you consider building a bank on the BaaS model, you should know that it has several layers:

- Infrastructure as a service (IaaS): on-demand Fintech and other services (e.g., lawyer or accountant service); it involves hardware and a server for communication.

- Banking as a platform (BaaP): a fully licensed platform or bank that other businesses use for providing their services.

- Fintech SaaS: on-demand financial services provided via BaaP; it also allows to plug in services provided by other banks (e.g., from traditional banking).

- Human as a service (HuaaS): a behind the scenes, top layer that represents the services provided by the Cloud workers.

Traditional universal banking — a model in which traditional banks create a digital bank solution (providing all or individual services). This is usually made to improve customer service for clients who prefer using the Internet or don’t have the time to be physically present in the bank.

5. Rules And Regulations

Financial services are tied to legislation. Therefore, you need to research the laws regarding banking and digital solutions in your country or region where you will be distributing them. Perhaps even consult with a lawyer before setting up a virtual bank. Here are some things to consider when setting up a bank in a digital environment:

- Digital signature — a way of verifying a person over the Internet; the very thing that makes online financial services possible. Find out how your future consumers can acquire a digital signature and what protocols you need to use it in your digital bank.

- Digital environment. The financial system does not always develop as fast as the digital environment. You need to create a virtual bank that will allow your consumers to stay within the law.

- Payment Services Directive 2 (PSD2) — the new requirements for customer authentication which take effect in September 2019.

- General Data Protection Regulation (GDPR) — the legal framework you need to consider before starting a bank. It was developed to protect EU citizens and residents that all companies operating in EU should comply with.

- Payment Card Industry Data Security Standard (PCI DSS) — for handling branded credit cards and addressing security threats. According to the standard, you need to have multi-factor authentication.

- New York State Department of Financial Service (NYSFS) — controls data protection in many different banks (around 1,500) and financial institutions, including international ones.

6. The Developer Team

Once you have covered all the details of your project on paper, the next logical step is to assemble a team that will develop a digital bank for you.

Steps To Take

- Assess the scale of the project.

- Figure out what kind of team you need.

- Determine the budget.

- Determine the desired development time frame.

The most common options are:

In-house developers

Banks usually hire specialists, but surely it’s not necessary, not for banks, nor independent Fintech companies (big or small) to have an in-house developers team. You can start a bank by hiring freelancers or an independent developer team. Moreover, hiring in-house developers is a long process that involves figuring out who you need and whether the candidates suit your requirements. You can hire a recruiting agency but that is additional expenses.

Freelancers

You can also develop a virtual bank by hiring freelancers. And while it is much cheaper, a lot of companies that go for the cheaper option, run into several problems. From experience, we know that:

- You have no guarantees they actually specialize in creating a bank or Fintech solutions.

- Freelancers tend to delay the deadlines and turn in poor-quality work if any.

- It’s hard to establish teamwork among freelancers, and not many entrepreneurs know to keep note of that.

- You run the risk of encountering incompetent developers who might also disappear without a word of acknowledgment.

Technical partners

There is also the option of finding a technical partner, a.k.a. a software development company or agency. They have well-established developer teams, that usually specialize in a specific industry. Still, to make a bank, you need to make sure the team you partner with has successful experience in the Fintech industry.

It’s important that you weigh out your options before you start a digital bank and choose the right one for your project so you don’t waste time or effort in the process. In any case, whether it’s a freelancer, an in-house developer, or a whole developer team, you should first study their portfolio.

At Gearheart, we have developed many successful projects, including different banking services. We can create a fraud-proof platform for you with features for issuing cards, doing background checks, signing checks, and scanning documents.

7. Marketing Campaigns

The goal of any business, from a financial standpoint, is income. How to make an online bank profitable? For that, a business needs clients and ways of attracting them. Marketing takes up to 20-25% of total expenses for some businesses, and, at the same time, your first campaign should launch along with the product launch. That’s quite a big budget line. Here, you have to be smart about setting up the first campaign.

It is important to build a digital bank marketing campaign around making financial services as simple and understandable as possible for the consumer. It is also important to include AI in your marketing campaigns: optimize, automate, test, and personalize them. Data-driven marketing helps you deliver the information you need.

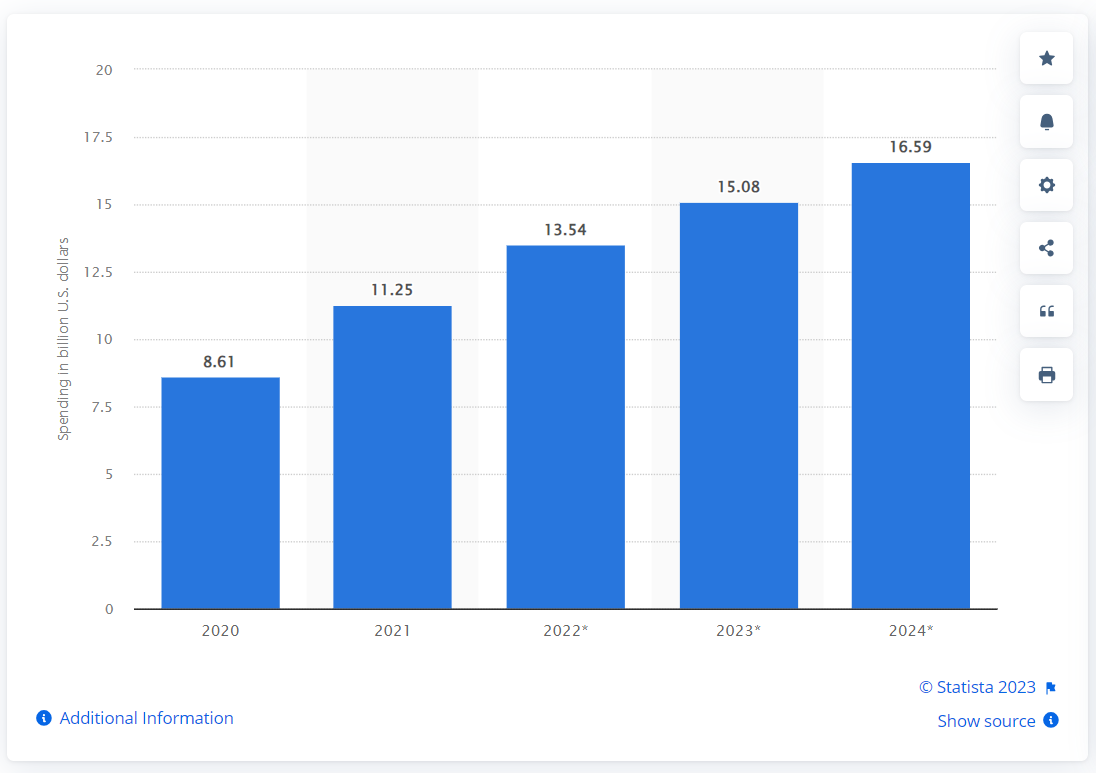

Banking digital advertising spending in the United States from 2020 to 2024 (in billion U.S. dollars)

Your promotional marketing strategy may include various channels. We will highlight the most common ones and highlight approximate costs to make it easier for you to navigate:

- Branding. Creating a corporate identity, brand voice, and message box is a fairly expensive and time-consuming process, which, according to experts, can cost upwards of $10,000.

- Website Development. Depending on the size and feature set, website development can range from $10,000 to $50,000.

- SEO. SEO optimization starts at an average of $2,000 per month.

- Social Media Marketing. Facebook, Twitter, LinkedIn, Instagram are great for quickly interacting with customers. You just need to determine what exactly your audience prefers and how best to interact through social media. The average cost of social media campaigns starts at $5,000 per month.

- Email Marketing. Email marketing is great for communicating with customers, and promoting new services and special offers. Depending on your subscriber base and email frequency, email marketing can cost you from $3,000 per month.

- Paid Advertising. Paid advertising campaigns may include search engine marketing, display advertising, and social media advertising. A combination of all these types per month can start at $10,000.

8. The Development Process

Now that you know your target audience and competitors from A to Z, you have decided on the technology, model, and type of project you are going to launch and how you are going to market it, you can now ship your requirements to the developer team.

When outsourcing web development, you should be aware of the peculiarities of the development process.

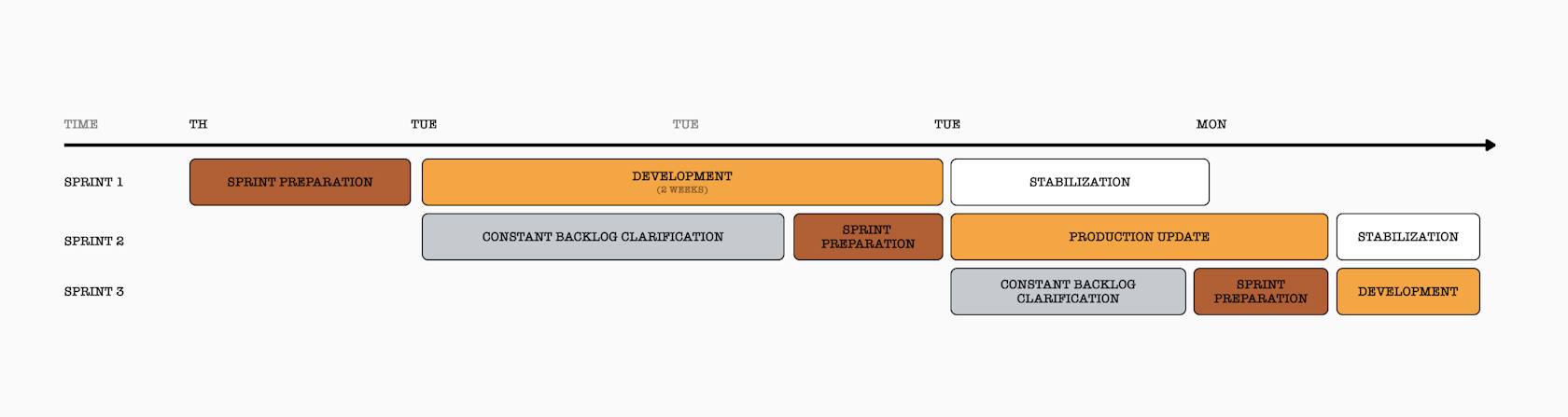

Gearheat is an Agile software development team specializing in custom-made web and mobile apps. We base our work on Scrum, continuous integration, and sprints (small iterations) to provide our clients with the most stable and productive results.

Each sprint consists of the preparation, development, stabilization, and deployment stages. So, before we develop a virtual bank for you or start any task, our business analyst gets in touch with the client and:

- makes sure that we understand what needs to be done;

- verifies that we have the needed resources;

- plans the sprint.

Development is carried out according to Agile principles, in which the process itself is divided into small iterations, that is, sprints. This way we can act accurately when forecasting deadlines and costs. In accordance with the agreed priority of tasks, our developers create functionality that is tested at the end of each sprint. After creating and testing the functionality in sprints, we can launch individual parts of the system into production. So you quickly get a working product that we continue to expand and improve further.

At the same time, you can observe and control the process via our task management system. The entire workflow is always available to clients: time logs, code, servers, documentation, etc.

9. The Budget

When wondering how to start an online banking company, you may be confused about how much the process will cost. We specifically raised this point separately, since the issue of expenses is always a sensitive and complex topic, especially in complex large-scale projects.

The cost of creating a banking application is heavily dependent on many factors. To get a rough idea of what it will take to build an app from scratch, you can look at the typical salary for software developers, the number of people involved in a project, and the duration of that project.

Please note that the final cost will also include the preparation phase, time for QA, as well as fees for third-party services. Besides, expenses are highly dependent on the country where your development team is located. For example, in the US and Eastern Europe, developers' hourly rate varies greatly, but the quality remains much the same.

If we talk about prices in more detail, then approximately the level of costs can be calculated using the example of one of our implemented projects in the US - a digital banking platform. You will not find this project among those published in our portfolio, since the project is under NDA. But based on the implemented functionality and the composition of the team, we can show the cost of developing such a platform.

So, the project included the implementation of the following features:

- maintaining personal and business accounts;

- management of physical and virtual cards;

- implementation of all main operations: transactions, deposits, loans, and bills;

- ATM map;

- receiving cashback;

- quiz with questions based on their transaction history.

The project team included:

- 1 PM;

- 1 BA;

- 4 developers;

- 1 DevOps;

- 2 QA.

Technologies used: Python, Django, Django REST Framework, Celery, PostgreSQL, ELK, ReactJS and NextJS*, Socure, Idology, AppsFlyer, Jumio, Plaid, TransferWise, Galileo, Twilio.

Now, based on these parameters, you can use a special calculator presented on our website. Taking into account the recruitment of the team, the monthly cost of developing such a platform will be $58,000 (Note: based on $60/hour for PM, Developers, DevOps, and BA, and $40/hour for QA).

Of course, for an accurate calculation and planning of the time frame, you better write to us, since the cost of development varies greatly depending on many factors that we described above.

WRAP UP

We hope that the time spent reading the article was compensated for you with a basic understanding of how to create an online banking system. All said and done, the rule of thumb here, before you start a virtual bank, is to weigh out all your options, all the pros and cons considering your digital bank requirements and business plan. And don’t miss out on statistics and factual data.

You can contact Gearheart and consult with our business analyst. How long should it take to create your own digital bank? We will help you estimate the time frame, figure out what technology and bank’s features you need to achieve your project goals, as well as give an estimate on the price.