Olivia

Financial Operations Automation Platform

Country: United StatesTechnologies: Django, Python, PostgreSQL, Angular, SassTime together: 9 years Team: PM, BA, 3 developers, QAOVERVIEW

Olivia is an internal project management system developed for the US boutique broker dealer firm Growth Capital Services. With Olivia, GCS provides brokers with a platform to perform financial operations in the expanding market of private securities where investors and entrepreneurs find each other to reach investment deals.

Broker-dealers needed highly secure financial automation software to partially automate the workflow with many confidential documents. The system should have customizable access for users with different rights to view and edit information. It was then that Olivia's idea came true.

When GCS first tried to transfer all paper information into electronic form, it helped to get rid of the piles of paper on the desktop, but the first version of Olivia, although it stored documents correctly, did not automate much of the workflow. When the company approached Gearheart, it took us some time to fix it, but we soon came to the conclusion that the concept of the system needed to be changed. We have identified the key activities performed by GCS employees and customers and developed a workflow algorithm. To ensure smooth financial automation, a state-of-the-art project management tool has been created. It supports task assignment and workflow editing and has a built-in drag-and-drop form editor, as well as a flexible notification system.

PURPOSE AND NEED

The world of private securities can be discouragingly confusing. It can be difficult to track down the information one needs to evaluate the underlying security and the credibility of the various parties to the transaction.

Besides, in the US, making investment deals and brokering activities are overregulated by numerous state and financial control agencies. Participants must fill out a huge variety of different documents in a strictly defined manner with many details, which are not to be neglected.

Growth Capital Services had the general understanding that they needed a financial process automation platform to bring together multiple parties of the deal to a successful transaction. Gearheart’s task was to fill this framework concept with the specific subject matter and create a secure, user-friendly system that could organize and handle a large amount of data.

The team came up with a very flexible way to set up the workflow, we were able to fully automate the process of assigning tasks and reviewers, as well as go through the deal from start to finish without missing a single important step.

Meet the people who made the product's features possible.

SOLUTION

To implement the initial concept, we proposed to develop an internal finance process automation tool to optimize the workflow by partially automating the process. Due to the peculiarities of the business area, we decided to build it around filling out forms and assigning tasks. In addition, due to security requirements, we blueprinted role-based user access to shared transactions and documents.

To match the concept, a simple user-friendly design was offered that included drag-and-drop workflow editing and form construction.

TECHNOLOGY

Under Olivia’s hood are Django, Django Rest Framework, MySQL, Solr, React, Typescript, and Webpack. As a result, by utilizing these technological solutions, we created a stable, secure, and fast financial close software that can process huge volumes of data and provide concurrent role-based access to multiple users.

STRUCTURE AND FEATURES

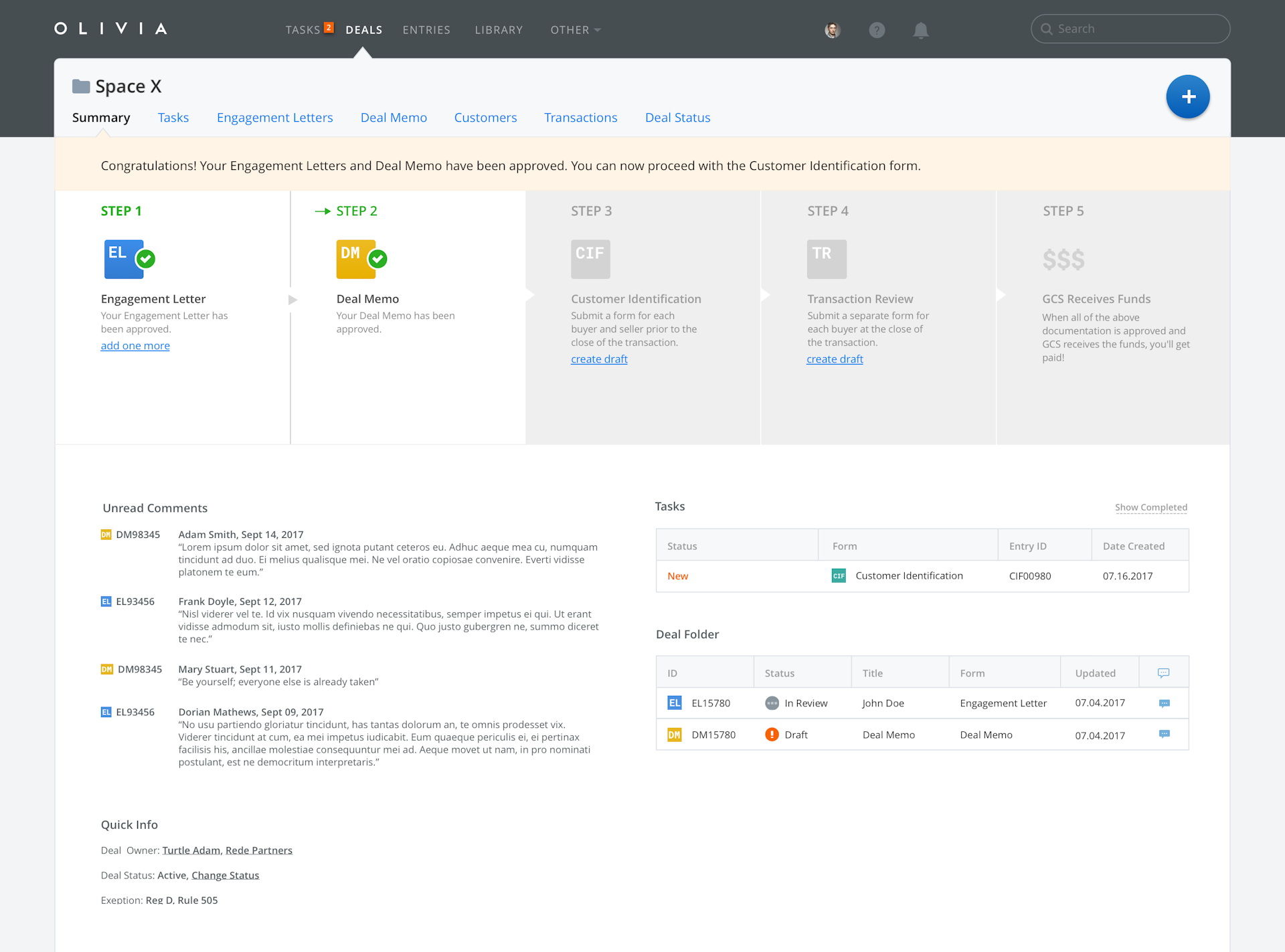

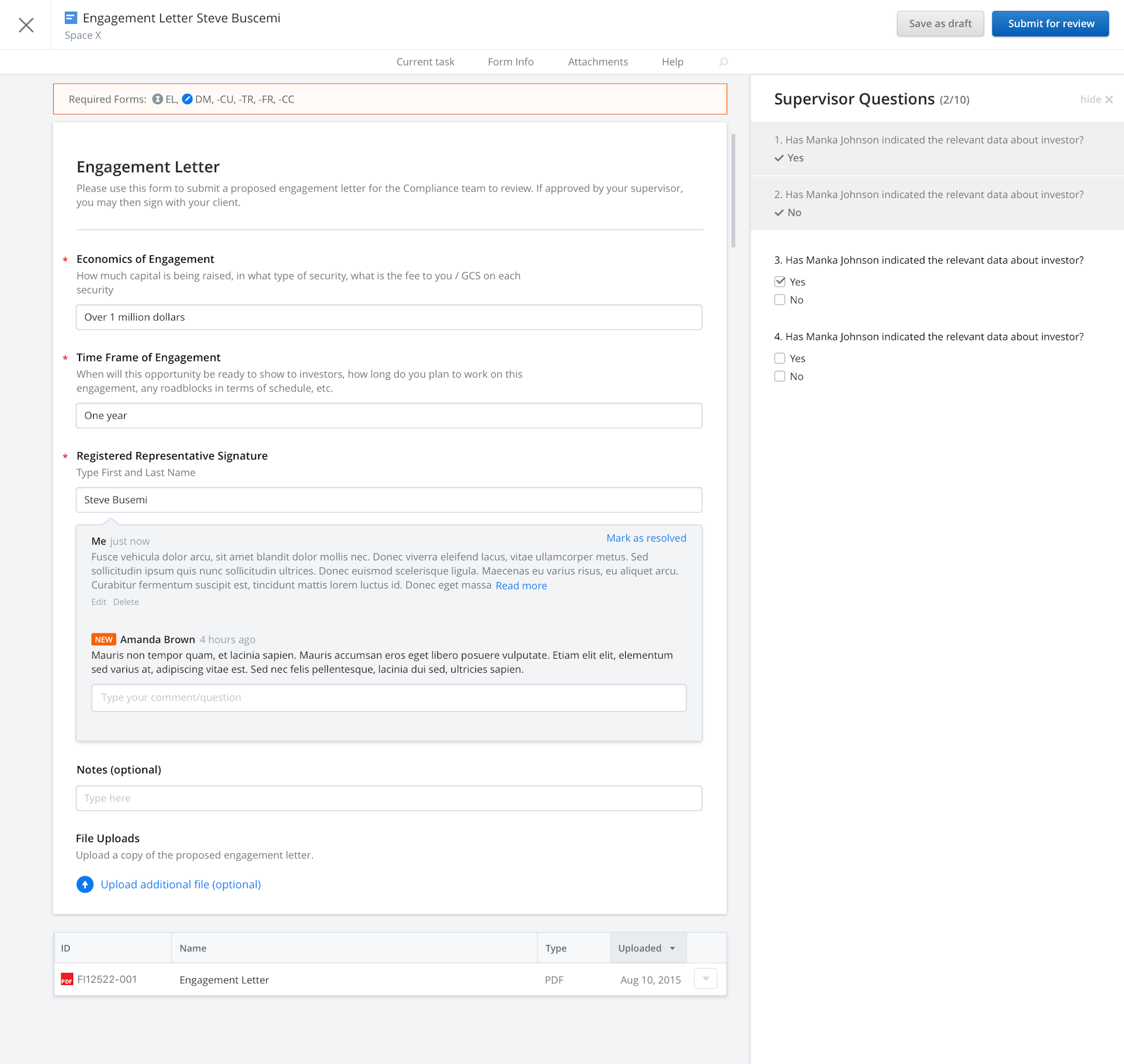

The workflow is built around processing e-declarations between clients and broker managers. Generally, a workflow algorithm looks like the one below:

• A representative (or in some cases, a client himself) fills in a form;

• A supervisor checks the form and either signs it or turns it back with comments and recommendations on what to correct;

• A representative prepares a new set of documents for the next client.

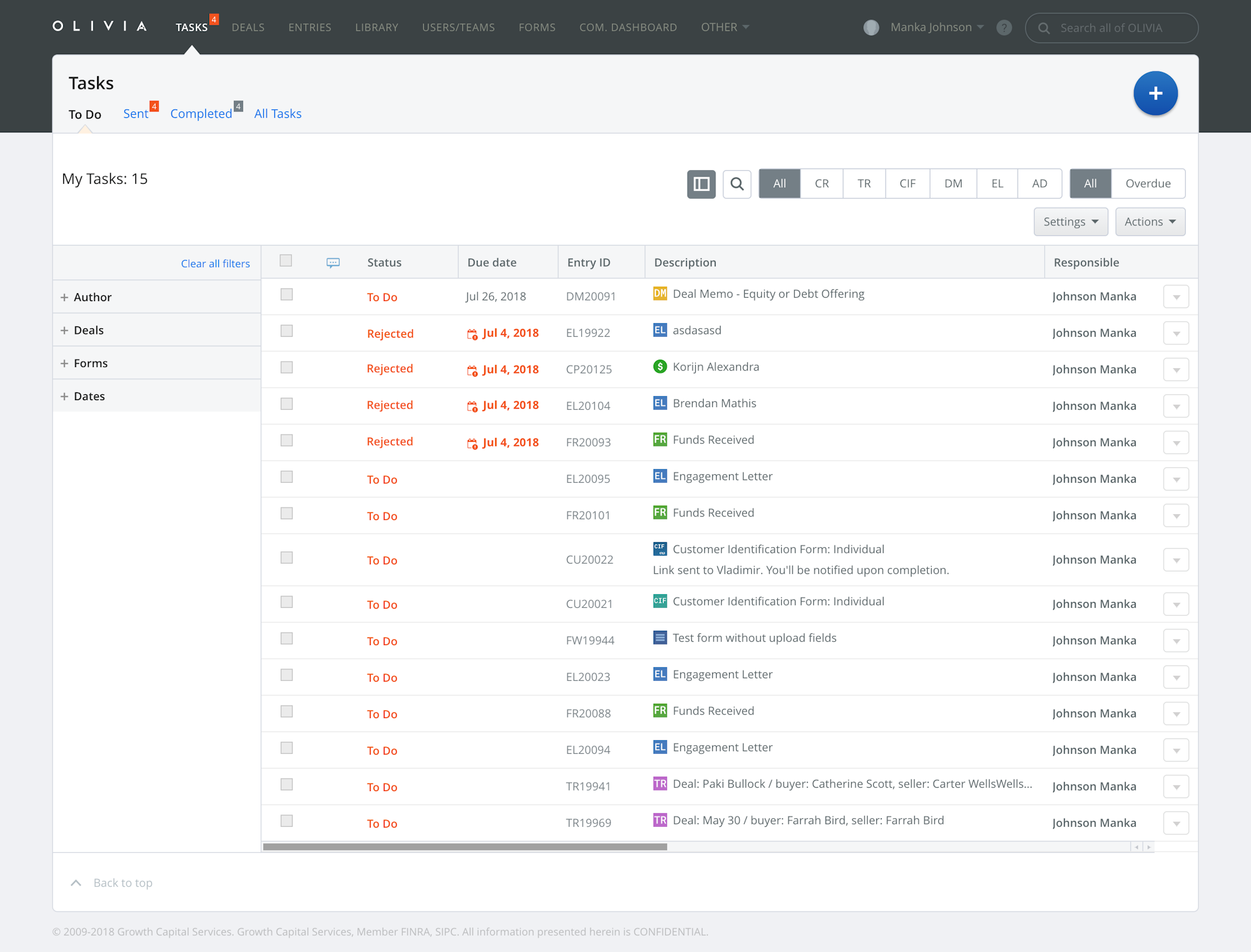

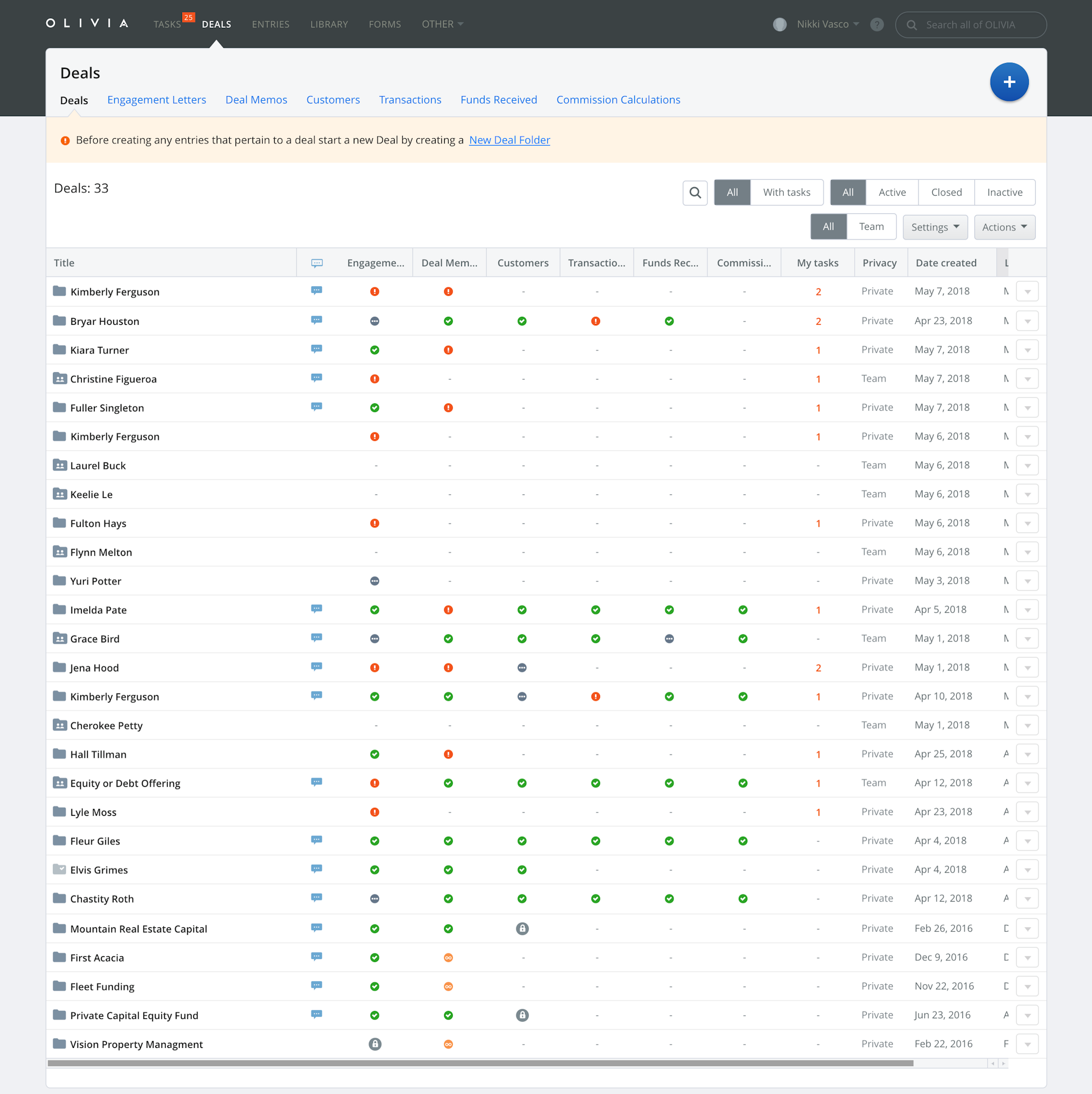

To seal a deal, a user must fill out on average seven forms (in total, there are roughly 100 different forms in the system). Each form is carefully checked; if it requires corrections, a user is prompted to fix it. Inside the system, we offered a color-based scheme that makes it much easier for users and managers to work with forms. Green means that the form is filled in correctly; blue indicates that it should be revised; red explicitly shows that there are major issues with the document. Also, the information from filled forms is used to create a database of buyers, sellers, and transactions.

Olivia’s structure lets users easily systemize all information on any deal in designated folders with a memo for each deal.

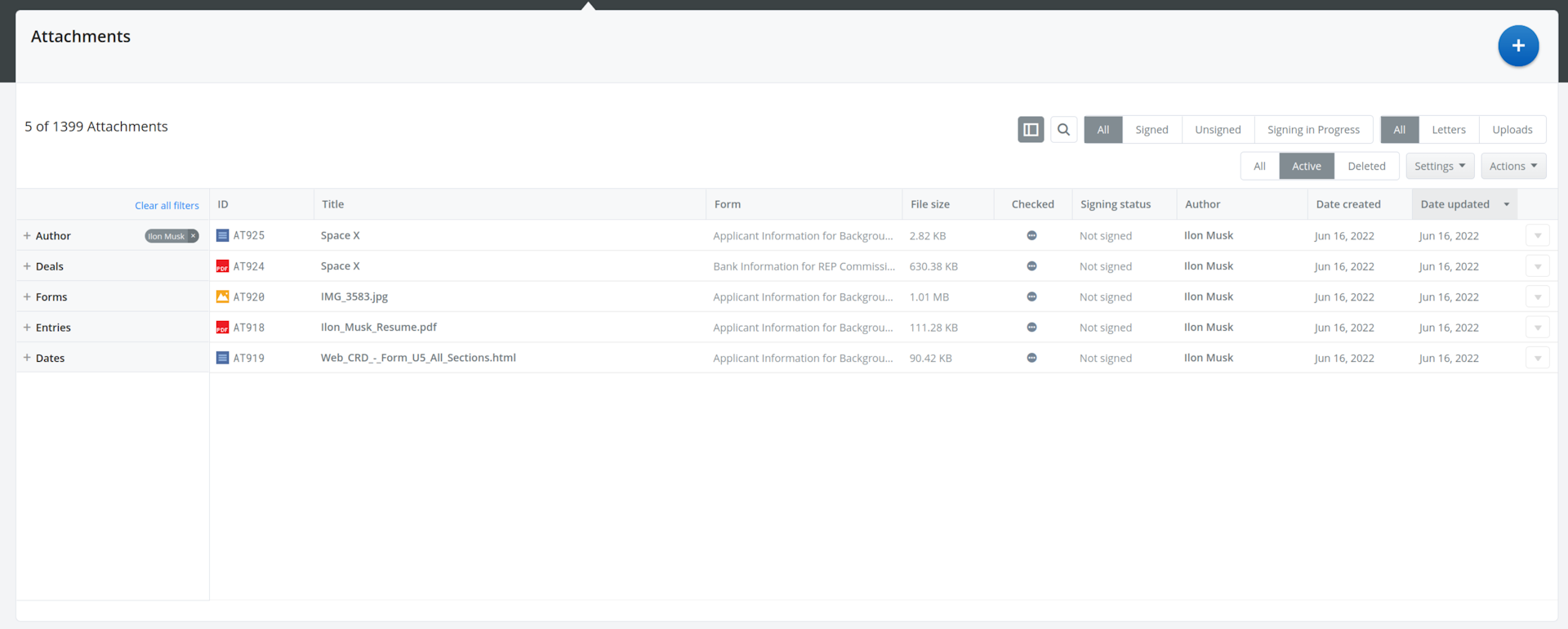

The data is presented in a table view; you can adjust the setting of displayed columns and change their placement and size. We created the special module with numerous flexible settings that allow us to filter out the data by relevance, status, date, author, and many other simple and complex rules. Table data can be exported to .xls(x) or .pdf files. You can also attach a necessary file when filling out forms and create deal engagement letters.

As a topping, office files can be signed right inside Olivia thanks to its integration with e-signature service HelloSign. This software provides legally binding digital signatures for applications, forms, contracts, invoices and more. The company’s data stays bank-level secure with SSL encryption and world-class server infrastructure. Herein, such signatures are valid all over the globe, including the US, the EU, and the UK.

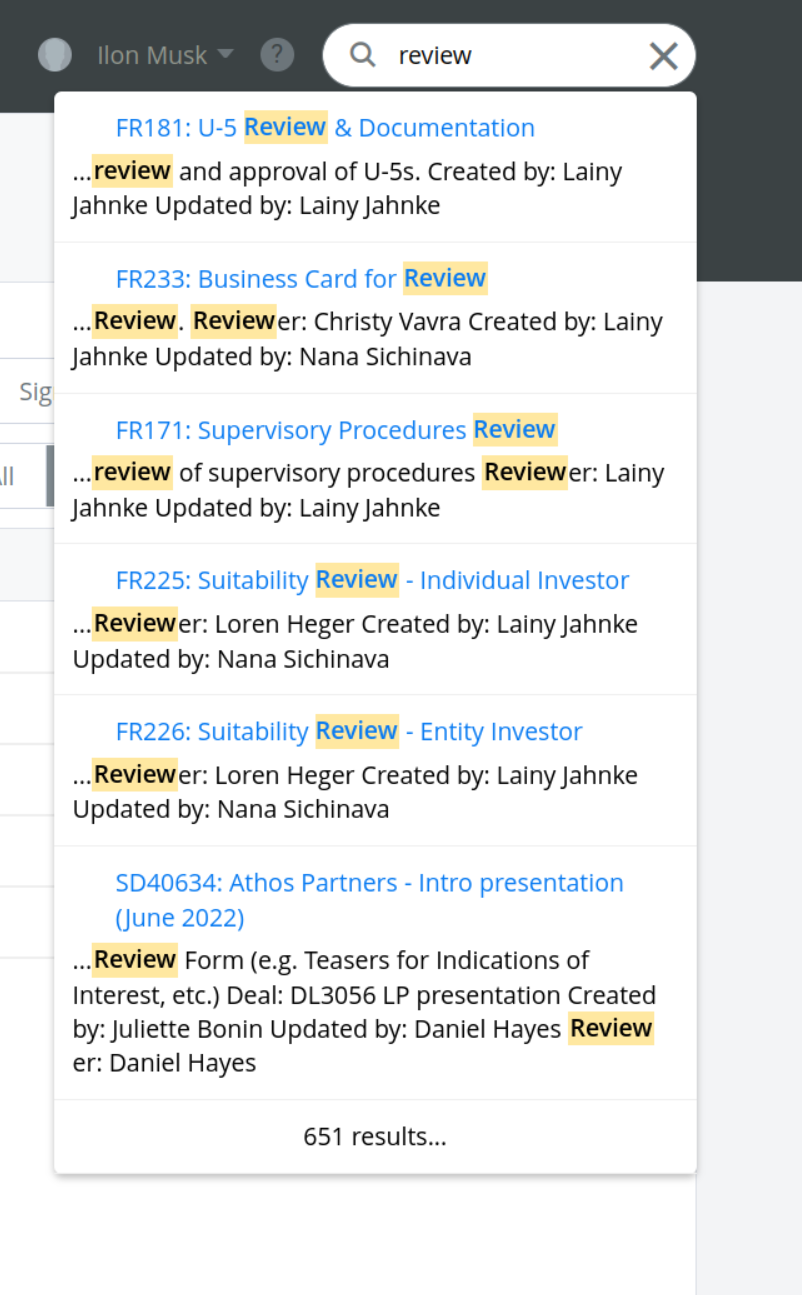

Apparently, with a huge volume of data in the system, one would need a comprehensive internal search to get around quickly. Olivia’s search engine makes it possible to look for any type of information in the system using multiple criteria to provide precise and detailed search results.

ROLE-BASED ACCESS

Due to broker business peculiarities and security reasons, in Olivia, we implemented role-based access. This means that, upon login, admins, supervisors, and representatives are granted a different set of rights to perform specific actions and utilize particular functions. If needed, you can split or merge roles to limit or expand access rights.

Role-based access is crucial for collaboration and concurrent work. With it, you can bring together several users in one team to handle the same deal. Herein, all “teammates” can access the deal they are working on but don’t see each other’s data on other deals.

Another useful feature of role-based access is that it allows brokers’ assistants to work with the system. Sometimes, bosses (brokers) are often busy with more important stuff than filling out forms. With a step-by-step built-in guide, their assistants can do the routine while their bosses are dealing with strategic issues.

Security is very important to us, the personal data of our customers and information about transactions are stored very carefully. We have repeatedly successfully passed the audit. Data security at the highest level.

ADVANCED SECURITY

When it comes to financial transactions, everyone understands that the issue of security is very important. Therefore, during development, we implemented a number of features aimed at secure data storage.

EMAIL 2FA

To protect our users, we implemented two-factor authentication via email. Olivia’s users undergo a mandatory HOTP token verification once a week. At the same time, the system carefully monitors from which device or even browser users log in, and each time they change, it asks for identity confirmation. Therefore, even if a fraudster steals a user's password, they will not be able to gain access to the project.

ACTIVITY DETECTION

The project implements monitoring of user activity. If a user is inactive for more than five hours, they will be automatically logged out. This helps protect against information theft if the user leaves the computer turned on and goes on vacation, for example.

ENCRYPTED DATABASE

Olivia's database is encrypted and placed on a separate server for security purposes.

CONTENT SECURITY POLICY

Olivia has several third-party client-side libraries embedded (e-signature service HelloSign, for example), and we use CSP mechanisms to protect against cross-site attacks.

CLOUDFLARE FIREWALL

For stable operation and guaranteed security on a public network, the application server is protected by a Cloudflare proxy firewall.

FORM BUILDER

Form structure changes periodically according to the control agencies’ requirements. To keep the process fast and smooth, we developed a drag-and-drop form editor. Thus, the admin can easily create new forms with a different set of fields to match up-to-date requirements. Also, we organized the form library. It contains roughly 100 forms for every occasion — for example, for describing a gift from a client to a supervisor (this is one of the legal requirements for brokers in the US).

The form builder contains over 30 fields that perform different types of tasks:

• Generic fields (text, numeric, date field, and many others)

• Financial fields for calculating commissions

• Markup fields

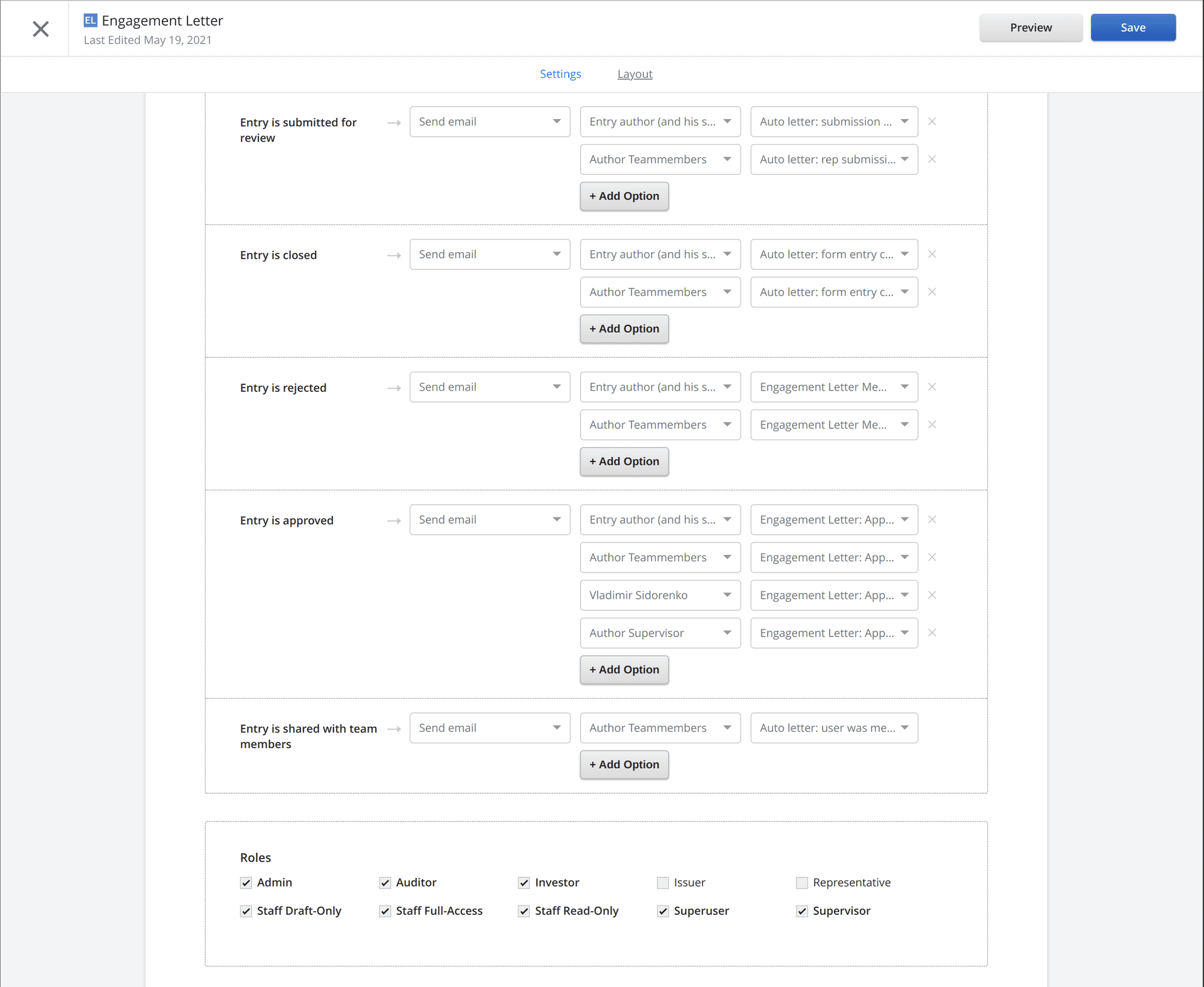

Also, for the convenience of users, we created the ability to flexibly configure email notifications when the state of a form entry changes.

But that's not all. Each form includes role-based access settings. Users can customize the list of groups that will have access to form entries.

LARGE FILES UPLOAD

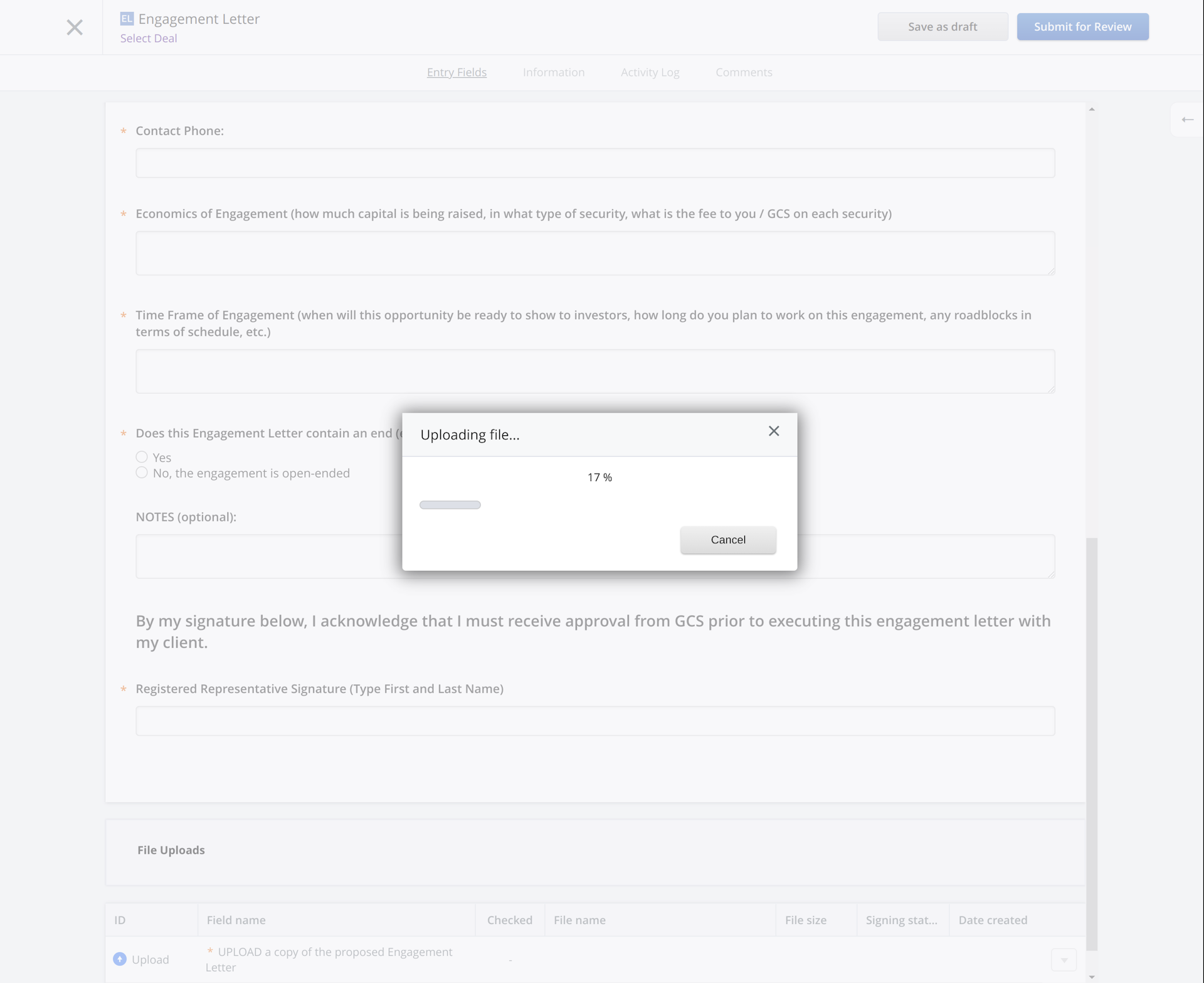

Our clients sometimes upload very large documents and video introductions. Here we faced two issues:

1. Request size limitation is determined by the Cloudflare proxy firewall.

2. Unstable Internet connections are an issue for some users.

We developed a special system — chunked file upload — which, unnoticeably for the user, splits the file into chunks and sends it, chunk by chunk, to Olivia's server.

If, during the upload process, the user loses their Internet connection for a short time, the upload of the file will not be interrupted; instead, Olivia will simply send the lost file chunk again. Thus, our users can download large files, even with a poor Internet connection.

AUTOMATED TESTING

It is very important for us that our product always works properly. For this reason, we paid a lot of attention to automated tests. Despite the fact that the project has grown very large over the years, the coverage of automated tests is 85%.

For 10 years of our cooperation, we only regret that we did not meet earlier.

RESULTS

• We modeled a comprehensive proprietary project management system for a highly specific business area, which ensures that every transaction meets or exceeds the criteria of securities regulatory requirements.

• In Olivia, we managed to combine a workflow function with a template form builder feature to develop a largely automated interface for independent registered brokers and representatives.

• Thanks to role-based access, Olivia is straightforward to provide different rights for various users.

• With its adaptive design, the site is optimized for tablet devices to provide smooth access on the go.

• We've been supporting Olivia since 2012, and during that time we've done two redesigns and added dozens of new features.

The major verdict of Gearheart's Olivia experience is that, with the right concept and technical approach, finance automation software with rigorous procedures and effective guidance in structuring and executing transactions can become a great solution, not an obstacle.

EARLY STAGE. GROWTH. ENTERPRISE

We combine AI, real engineering, and product thinking to help B2B SaaS founders move fast. Over 13 years and 70+ products, we’ve tailored our approach to every stage of the journey.